IUX (also known as IUX Markets) is a forex and CFD broker established in 2019 with its headquarters in Mauritius. The broker has gained visibility in regions such as the UAE, Australia, Brazil, and parts of Europe, achieving a WikiFX Score of 6.08. While the broker holds licenses from reputable authorities like ASIC and FSCA, recent data indicates a significant volume of user complaints regarding fund security and operational issues.

This review analyzes the brokers regulatory framework, trading conditions, and the serious exposure regarding withdrawal delays reported by users in 2024 and 2025.

Is IUX Legit? Regulatory Status and Safety

The most important factor in assessing a broker is its regulatory oversight. IUX currently holds licenses from two major financial authorities. However, investors should also be aware of negative disclosures from other regulatory bodies.

IUX License Overview

| Regulator | Country | License Details | Status |

|---|---|---|---|

| ASIC (Australian Securities & Investments Commission) | Australia | License No. 529610 | Regulated |

| FSCA (Financial Sector Conduct Authority) | South Africa | License No. 53103 | Regulated |

Regulatory Warnings

Despite holding Tier-1 regulation in Australia, IUX has faced scrutiny in other jurisdictions. Data from the Cyprus Securities and Exchange Commission (CySEC) indicates negative disclosures. In 2025, CySEC issued warnings regarding unauthorized entities associated with IUX domains (e.g., iux.com), placing them on a warning list/blacklist for offering investment services without local authorization.

While the ASIC and FSCA licenses provide a level of legitimacy, the cross-border warnings suggest that traders outside of the protected jurisdictions should exercise caution.

IUX Exposure: Withdrawal Failures and User Complaints

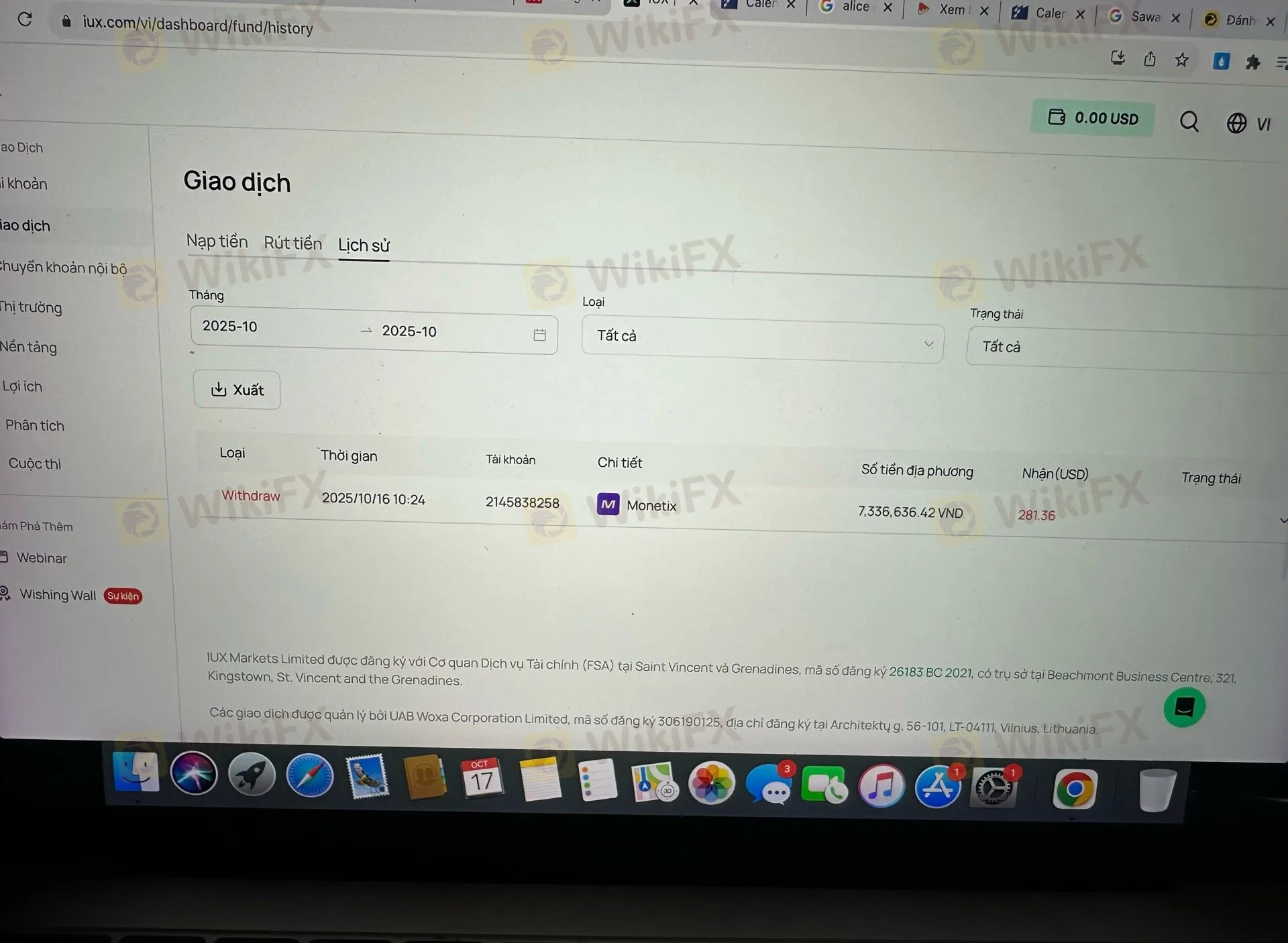

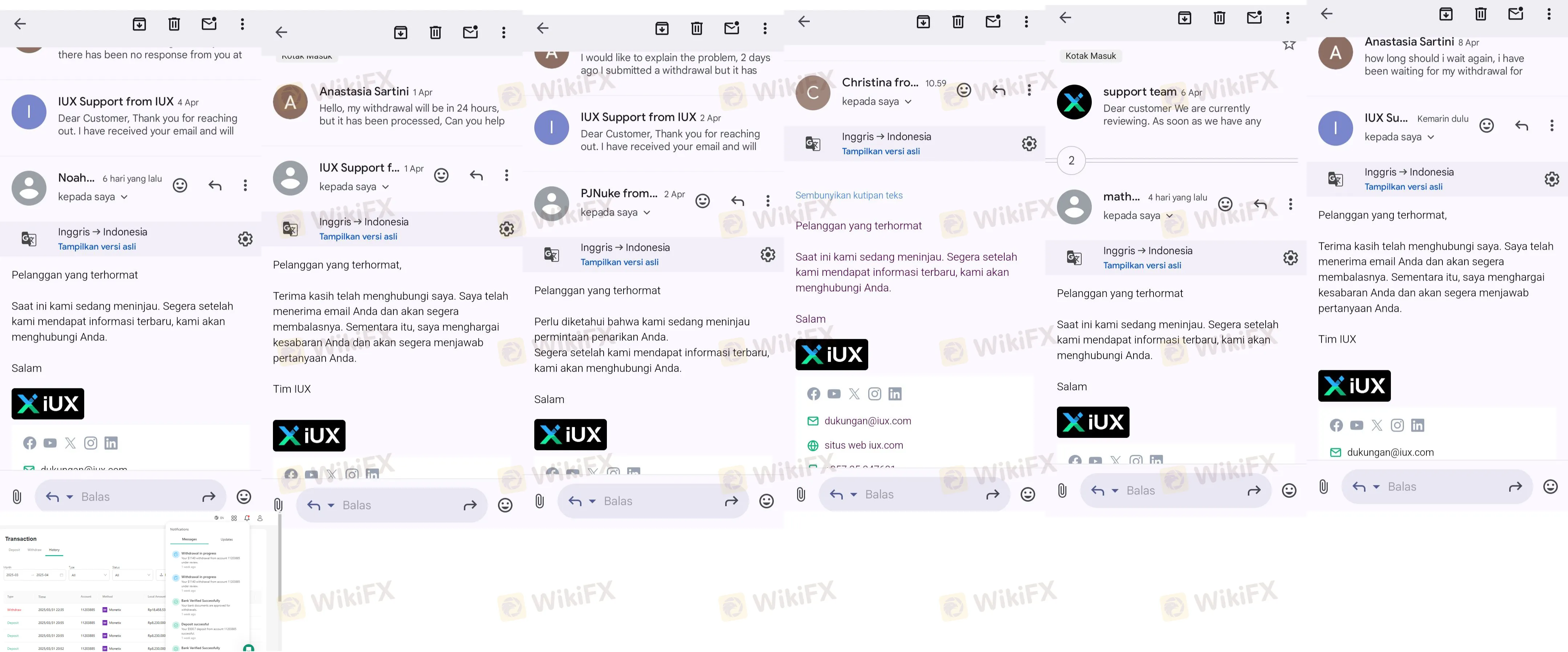

Although the broker opens accounts easily and supports digital processes, the user feedback regarding post-trading operations is concerning. Over the last three months, there have been 19 reported complaints, with a total of nearly 30 specific cases detalied in the data.

Major Complaint Themes

1. Persistent Withdrawal Delays

The majority of complaints hail from Vietnam, Indonesia, Thailand, and India. Users consistently report that withdrawals remain in a “Pending” or “Processing” state for extended periods—ranging from several days to over two weeks.

- Case Example (Vietnam): A user reported a withdrawal request from October 16, 2025, that remained unprocessed. Support staff reportedly told the user to “wait” without providing a specific timeframe.

Case Example (Indonesia): A user attempting to withdraw $1,140 waited over 10 days. Despite daily complaints, the status remained pending.

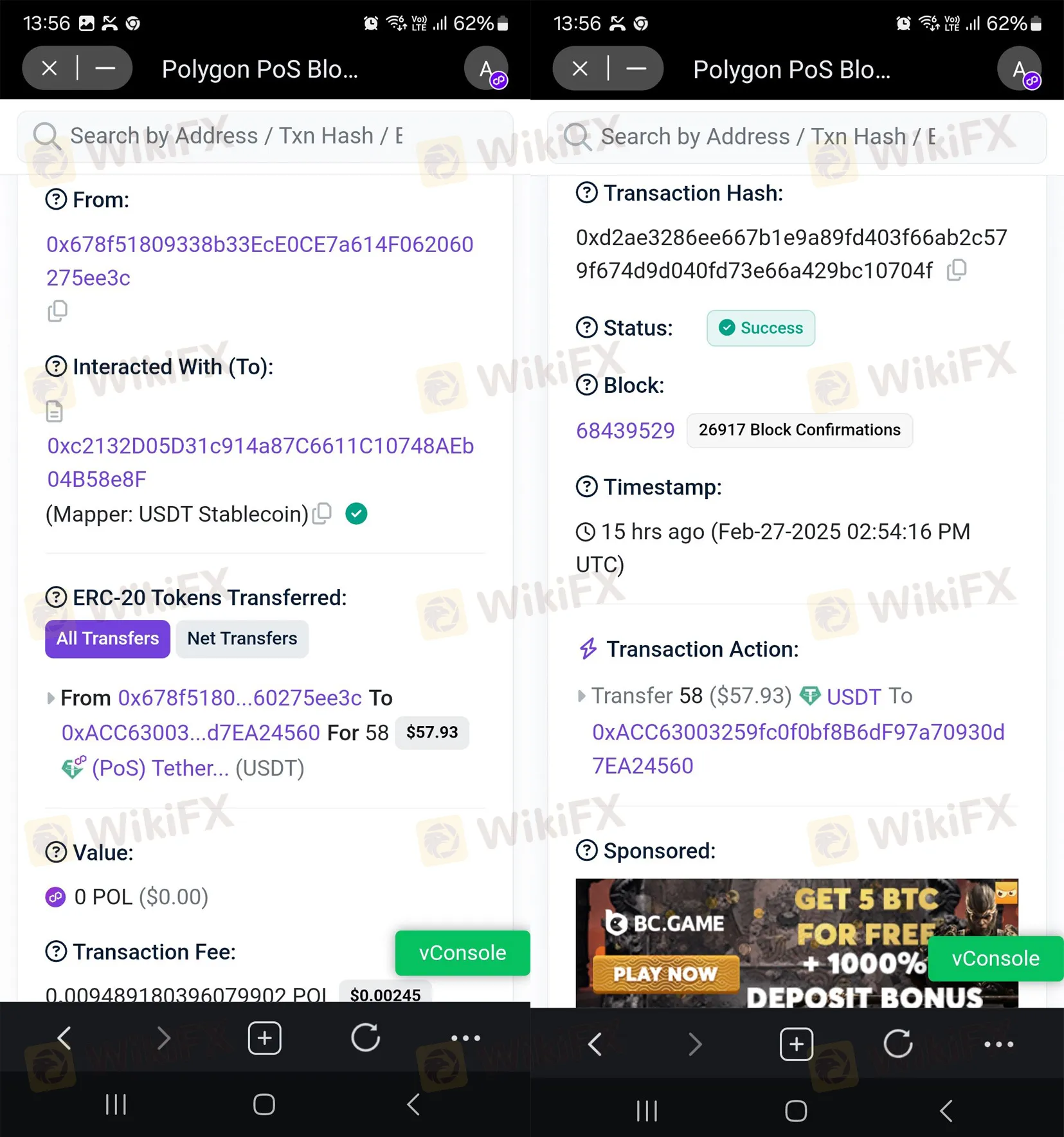

2. Deposit Issues (Crypto)

Several traders reported issues with cryptocurrency deposits, specifically USDT.

- Case Example (Thailand): A user deposited 58 USDT which never reflected in the trading account. Despite providing the TXID (transaction hash), the support team claimed they were “checking” but ceased providing updates.

3. Account Blocking and Profit Cancellation

More severe allegations involve the deletion of profits and account locking.

- Case Example (Thailand): A trader reported that after making a profit, IUX refused the withdrawal, claiming the user’s IP address matched another user’s (an “IP overlap”). The broker allegedly confiscated the profits, leaving only the principal capital, and closed the account. The user denied knowing the other party, stating they used a new phone and SIM card.

4. Slippage and Price Execution

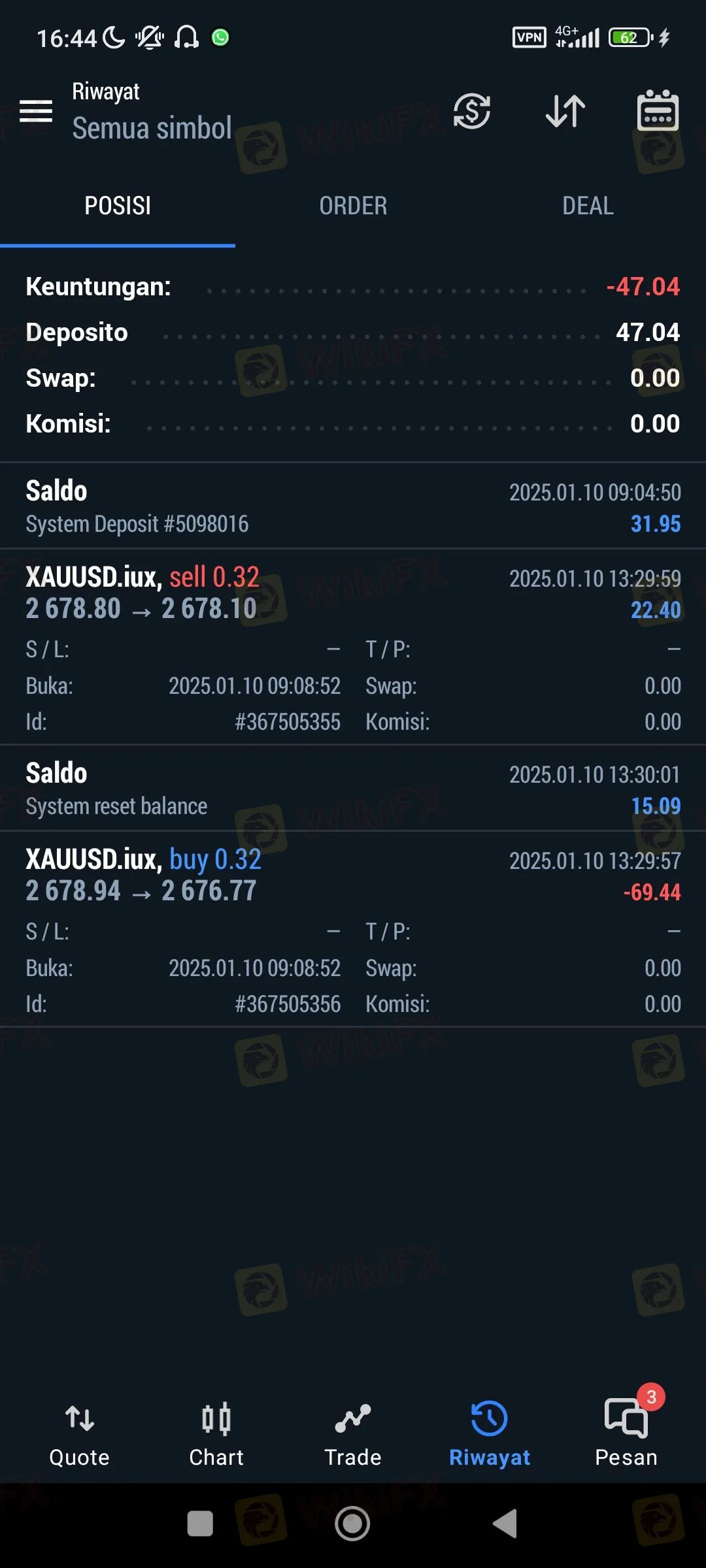

Users from Indonesia have reported unnatural price closing. One user noted their Buy position was closed at a price lower than the market rate during stable conditions, resulting in an unfair loss.

IUX Trading Fees, Leverage, and Accounts

For traders who can overlook the operational risks, IUX offers competitive trading conditions characterized by very high leverage and low entry barriers.

Account Types

IUX offers three main account types. All accounts are swap-free capable (“transactionType”: null, but implies Islamic/standard structures often have this) and support Expert Advisors (EAs) and Scalping.

| Account Type | Minimum Deposit | Spread From | Commission |

|---|---|---|---|

| Standard | $10 | 0.2 pips | None/Low |

| Professional | $500 | 0.1 pips | None/Low |

| Raw | $500 | 0.0 pips | Commission applies |

Leverage and Platform

- Maximum Leverage: IUX offers extremely high leverage of up to 1:3000. While this allows for high-volume trading with small capital, it significantly increases the risk of rapid liquidation.

- Trading Platform: The broker utilizes the MT5 (MetaTrader 5) platform and a proprietary mobile app.

- Platform Limitations: Data suggests the proprietary tools are mobile-focused (iOS/Android). There is information indicating a lack of native support for Windows/MacOS desktop applications outside of the standard MT5 environment.

Pros and Cons of IUX

Pros

- Regulated by ASIC (Australia) and FSCA (South Africa).

- Very low minimum deposit ($10 for Standard accounts).

- Extremely high leverage available (1:3000).

- Offers MT5 trading platform.

- Spreads start from 0.0 pips on Raw accounts.

Cons

- High volume of withdrawal complaints active in 2024 and 2025.

- Warnings/Blacklist status issued by CySEC regarding unauthorized domains.

- Reports of profit cancellation due to “IP address overlap.”

- Crypto deposit failures reported by users.

- Limited PC/Web platform support for the proprietary software.

Final Verdict: Can You Trust IUX?

IUX presents a complex profile. On paper, it appears legitimate due to its ASIC and FSCA licenses and a reasonable WikiFX score of 6.08. However, the practical experience of traders paints a different picture. The overwhelming number of recent complaints regarding unprocessed withdrawals, missing deposits, and account closures suggests significant operational risks.

The regulatory warnings from CySEC further indicate that the broker may be operating aggressively in jurisdictions where it lacks authorization. While the trading conditions (high leverage, low spreads) are attractive, the risk of being unable to withdraw profits is a critical concern.

Recommendation: Traders are advised to proceed with extreme caution. The high leverage combined with substantiated reports of withdrawal blocks makes this a high-risk broker for holding significant capital.

Ensure you protect your capital by checking the latest broker reports and complaints on the WikiFX App before opening an account.